FORTRESS BIOTECH, INC.

1111 Kane Concourse Suite 301

Bay Harbor Islands, FL 33154

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

FORTRESS

BIOTECH, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required |

| ¨ | Fee paid previously with preliminary materials |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

FORTRESS BIOTECH, INC.

1111 Kane Concourse Suite 301

Bay Harbor Islands, FL 33154

Dear Stockholder:

You are cordially invited to attend a Special Meeting of Stockholders (the “Special Meeting”) of Fortress Biotech, Inc. (the “Company”) to be held on Monday, April 10, 2023 at 10:30 a.m. ET. The Special Meeting will be completely virtual and conducted by means of a live webcast as described below, which can be accessed at www.virtualshareholdermeeting.com/FBIO2023SM when you enter your 16-digit control number included with the proxy card. At the Special Meeting, the stockholders will be asked to (i) approve the rights and Contingent Subsidiary Securities (as defined in the proxy statement) in order to satisfy the requirements of Nasdaq Listing Rule 5635(c) and (ii) transact any other business that may properly come before the Special Meeting or any adjournment of the Special Meeting. You will also have the opportunity to ask questions and make comments at the Special Meeting.

This proxy statement is being furnished to you in accordance with Rule 14a-16 promulgated under the Securities Exchange Act of 1934, as amended. This proxy statement is first being mailed to you on or about March 13, 2023.

It is important that your stock be represented at the Special Meeting regardless of the number of shares you hold. You are encouraged to specify your voting preferences by marking our proxy card and returning it as directed. If you do attend the Special Meeting virtually and wish to vote live during the meeting, you may revoke your proxy at the Special Meeting.

If you have any questions about the proxy statement, please contact David Jin, our Chief Financial Officer at 781-652-4500.

We look forward to seeing you at the Special Meeting.

| Sincerely, | |

| /s/ Lindsay A. Rosenwald, M.D. | |

| Lindsay A. Rosenwald, M.D. | |

| Executive Chairman, Chief Executive Officer and President |

March 13, 2023

Bay Harbor Islands, FL

FORTRESS BIOTECH, INC.

1111 Kane Concourse Suite 301

Bay Harbor Islands, FL 33154

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on April 10, 2023. This notice of meeting and the accompanying proxy statement are available at http://materials.proxyvote.com/34960Q.

Special Meeting Will be Conducted Virtually

To facilitate greater shareholder access, Fortress is hosting a completely virtual Special Meeting. You may attend the webcast of the meeting via the internet on April 10, 2023 at 10:30 a.m. ET, at www.virtualshareholdermeeting.com/FBIO2023SM when you enter your 16-digit control number included with the proxy card. Instructions on how to attend and participate in the Special Meeting via the webcast are posted on www.virtualshareholdermeeting.com/FBIO2023SM. You will be able to vote your shares by following the instructions on the website and ask questions by using the question box on the virtual meeting platform. At the meeting, stockholders will consider and act on the following items:

| 1. | The issuance of the rights and Contingent Subsidiary Securities in order to satisfy the requirements of Nasdaq Listing Rule 5635(c); and |

| 2. | The transaction of any other business that may properly come before the Special Meeting or any adjournment of the Special Meeting. |

Only those stockholders of record as of the close of business on February 9, 2023 are entitled to vote at the Special Meeting or any postponements or adjournments thereof. A complete list of stockholders entitled to vote at the Special Meeting will be available for your inspection 10 days preceding our Special Meeting, at our offices located at 1111 Kane Concourse Suite 301 Bay Harbor Islands, FL 33154, between the hours of 10:00 a.m. and 5:00 p.m., local time, each business day, or if we determine that a physical in-person inspection is not practicable, such list of stockholders may be made available electronically, upon request.

YOUR VOTE IS IMPORTANT!

Please sign, date and return your proxy card as soon as possible to make sure that your shares are represented at the Special Meeting. If you are a stockholder of record, you may also cast your vote at the Special Meeting by submitting a ballot via the live webcast. If your shares are held in an account at a brokerage firm or bank, you must instruct your broker or bank how to vote your shares, or you may cast your vote at the Special Meeting by obtaining a proxy from your brokerage form or bank.

Submitting your proxy does not affect your right to vote if you decide to attend the Special Meeting. You are urged to submit your proxy as soon as possible, regardless of whether or not you expect to attend the Special Meeting. You may revoke your proxy at any time before it is voted at the Special Meeting by (i) delivering written notice to our General Counsel and Corporate Secretary, Sam Berry, at our address above, (ii) submitting a later dated proxy card, (iii) voting again via the Internet as described in the proxy card, or (iv) attending the Special Meeting and voting. No revocation under (i) or (ii) will be effective unless written notice or the proxy card is received by our Corporate Secretary at or before the Special Meeting.

When you submit your proxy, you authorize Lindsay A. Rosenwald, M.D. and David Jin to vote your shares at the Special Meeting and on any adjournments of the Special Meeting in accordance with your instructions.

| By Order of the Board of Directors, | |

| /s/ Sam Berry | |

| Sam Berry | |

| General Counsel and Corporate Secretary |

March 13, 2023

Bay Harbor Islands, FL

FORTRESS BIOTECH, INC.

1111 Kane Concourse Suite 301

Bay Harbor Islands, FL

Phone: (781) 652-4500

Fax: (781) 459-7788

PROXY STATEMENT

This proxy statement and the form of proxy is being furnished to the owners of shares of common stock of Fortress Biotech, Inc. (the “Company,” “our,” “we,” or “Fortress”) as of February 9, 2023, in connection with the solicitation of proxies by our Board of Directors for our 2023 Special Meeting of Stockholders (the “Special Meeting”). This proxy statement contains important information about the Special Meeting and the proposal described herein. Please read it carefully and vote your shares.

This proxy statement is dated March 13, 2023, and is first being mailed to stockholders on or about that date.

The Special Meeting will be held by live webcast on April, 10, 2023 at 10:30 a.m. ET. You may access the meeting via the internet at www.virtualshareholdermeeting.com/FBIO2023SM when you enter your 16-digit control number included with the proxy card. The virtual meeting platform is supported across browsers (e.g., Internet Explorer, Firefox, Chrome, and Safari) and devices (including desktops, laptops, tablets, and mobile devices) running the most updated version of applicable software and plugins. You should ensure that you have a strong internet connection from wherever you intend to participate in the Special Meeting. Our Board of Directors encourages you to read this document thoroughly and take this opportunity to vote, via proxy, on the matters to be decided at the Special Meeting. As discussed below, you may revoke your proxy at any time before your shares are voted at the Special Meeting.

TABLE OF CONTENTS

i

| Q. | Why did I receive this proxy statement? |

| A. | In accordance with Securities and Exchange Commission (“SEC”) rules, this proxy statement and the enclosed proxy card are being sent to you in connection with the solicitation of proxies by our Board for use at the Special Meeting, or at any adjournments thereof. This proxy statement summarizes the information that you need to make an informed decision on the proposals considered at the Special Meeting. |

| Q. | When is the Special Meeting? |

| A. | The Special Meeting will be held at 10:30 a.m. ET on April 10, 2023. |

| Q. | Where will the Special Meeting be held? |

| A. | The Special Meeting will be held virtually by means of a live webcast, as further described herein, which can be accessed at www.virtualshareholdermeeting.com/FBIO2023SM when you enter your 16-digit control number included with the proxy card. |

| Q. | What is the purpose of the Special Meeting? |

| A. | At the Special Meeting, our stockholders will act upon the matters outlined in this proxy statement, namely: (i) approving the issuance of the rights and Contingent Subsidiary Securities (defined below) in order to satisfy the requirements of Nasdaq Listing Rule 5635(c); and (ii) transacting any other business that may properly come before the Special Meeting or any adjournment thereof. |

| Q. | How many votes do I have? |

| A. | On each matter to be voted upon, you have one vote for each share of common stock you own as of the close of business on February 9, 2023 (the “Record Date”). |

| Q. | Who is entitled to vote at our Special Meeting? |

| A. | Only stockholders of record as of the Record Date, are entitled to receive notice of the Special Meeting and to vote the shares that they held on that date at the Special Meeting, or any adjournment or postponement thereof. As of the close of business on the Record Date, we had 113,441,964 shares of common stock outstanding. Each share of common stock entitles its holder to one vote at the Special Meeting. A list of stockholders entitled to vote at the Special Meeting, may be examined at our offices located at 1111 Kane Concourse Suite 301 Bay Harbor Islands, FL 33154, between the hours of 10:00 a.m. and 5:00 p.m., local time, each business day, 10 days preceding the Special Meeting, or if we determine that a physical in-person inspection is not practicable, such list of stockholders may be made available electronically, upon request. |

| ● | Stockholders of Record: Shares Registered in Your Name. If on the Record Date your shares were registered directly in your name with our transfer agent, VStock Transfer LLC, then you are a stockholder of record. As a stockholder of record, you may vote live during the Special Meeting or vote by proxy. Whether or not you plan to participate live during the Special Meeting, we urge you to fill out and return the enclosed proxy card, to ensure your vote is counted. |

| ● | Beneficial Owner: Shares Registered in the Name of a Broker, Bank, Custodian or Other Nominee. If on the Record Date your shares were held in an account at a brokerage firm, bank, custodian or other nominee, then you are a beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Special Meeting. As a beneficial owner, you have the right to direct your broker, bank, custodian or other nominee on how to vote the shares in your account. You are also invited to participate live in the Special Meeting. However, because you are not the stockholder of record, you may not vote your shares live during the Special Meeting unless you request and obtain a valid proxy from your broker, bank, custodian or other nominee. |

1

| Q. | How do I vote? |

| A. | Whether you hold shares directly as the stockholder of record or indirectly as the beneficial owner of shares held for you by a broker or other nominee (i.e., in “street name”), you may direct your vote without attending the Special Meeting. You may vote by granting a proxy or, for shares you hold in street name, by submitting voting instructions to your broker or nominee. In most instances, you will be able to do this by internet, telephone or by mail. Please refer to the summary instructions below and those included on your proxy card or, for shares you hold in street name, the voting instruction card provided by your broker or nominee. |

| ● | By Internet - If you have Internet access, you may authorize your proxy from any location in the world as directed in the proxy card. |

| ● | By Telephone - If you are calling from the United States or Canada, you may authorize your proxy by following the “By Telephone” instructions on the proxy card or, if applicable, the telephone voting instructions that may be described on the voting instruction card sent to you by your broker or nominee. |

| ● | By Mail - You may authorize your proxy by signing your proxy card and mailing it in the enclosed postage-prepaid and addressed envelope. For shares you hold in street name, you may sign the voting instruction card included by your broker or nominee and mail it in the envelope provided. |

You may also vote live during the Special Meeting by following the instructions posted at www.virtualshareholdermeeting.com/FBIO2023SM and entering your 16-digit control number included with the proxy card. If you choose to vote during the Special Meeting, the virtual meeting platform is supported across browsers (e.g., Internet Explorer, Firefox, Chrome, and Safari) and devices (including desktops, laptops, tablets, and mobile devices) running the most updated version of applicable software and plugins. You should ensure that you have a strong internet connection from wherever you intend to participate in the Special Meeting.

| Q: | What if I have technical difficulties or trouble accessing the virtual Special Meeting? |

| A. | Our virtual meeting platform provider will have technicians ready to assist you with any technical difficulties you may have accessing the virtual Special Meeting. If you encounter any difficulties accessing the virtual Special Meeting during the check-in or meeting time, please call the technical support number located on the meeting page. |

| Q. | What is a proxy? |

| A. | A proxy is a person you appoint to vote your shares on your behalf. If you are unable to attend the Special Meeting, our Board of Directors is seeking your appointment of a proxy so that your shares may be voted. If you vote by proxy, you will be designating Lindsay A. Rosenwald, M.D., our Executive Chairman, Chief Executive Officer and President, and David Jin, our Chief Financial Officer, or either of them, as your proxies. In such event, Dr. Rosenwald and/or Mr. Jin may act on your behalf and have the authority to appoint a substitute to act as your proxy. |

| Q. | How will my shares be voted if I vote by proxy? |

| A. | Your proxy will be voted according to the instructions you provide. If you complete and submit your proxy but do not otherwise provide instructions on how to vote your shares, your shares will be voted “FOR” Proposal No. 1, the approval of the issuance of the rights and Contingent Subsidiary Securities in order to satisfy the requirements of Nasdaq Listing Rule 5635(c). Presently, our Board does not know of any other matter that may come before the Special Meeting. However, your proxies are authorized to vote on your behalf, using their discretion, on any other business that properly comes before the Special Meeting. |

2

| Q. | Can I change my vote after I return my proxy card? |

| A. | Yes. You may revoke your proxy at any time before the final vote at the Special Meeting by: |

If you are the record holder of your shares, you may revoke your proxy in any one of three ways:

| ● | You may send a written notice that you are revoking your proxy to our General Counsel and Corporate Secretary, Sam Berry, at our address above (so long as we receive such notice no later than the close of business on the day before the Special Meeting); |

| ● | You may submit a later dated proxy card or voting again via the Internet as described in the proxy card; or |

| ● | You may attend the virtual Special Meeting and notify the election officials at the Special Meeting that you wish to revoke your proxy and vote live during the Special Meeting by following the instructions posted at www.virtualshareholdermeeting.com/FBIO2023SM. Simply attending the Special Meeting will not, by itself, revoke your proxy. |

If your shares are held by your broker, bank, custodian or other nominee, you should follow the instructions provided by such broker, bank, custodian or other nominee.

| Q. | How are votes counted? |

| A. | Before the Special Meeting, our Board of Directors will appoint one or more inspectors of election for the meeting. The inspector(s) will determine the number of shares represented at the meeting, the existence of a quorum and the validity and effect of proxies. The inspector(s) will also receive, count, and tabulate ballots and votes and determine the results of the voting on each matter that comes before the Special Meeting. |

| Q. | What is the effect of abstentions or broker non-votes? |

| A. | Abstentions, and shares represented by proxies reflecting abstentions, will be treated as present for purposes of determining the existence of a quorum at the Special Meeting. They will not be considered as votes “for” or “against” any matter for which the stockholder has indicated their intention to their vote, but because the voting standard for Proposal No. 1 is based on a majority of the votes present virtually or by proxy at the Special Meeting, they will have the same effect as a negative vote. |

Broker non-votes occur when shares are held indirectly through a broker, bank or other nominee or intermediary on behalf of a beneficial owner (referred to as held in “street name”) and the broker submits a proxy, but does not cast a vote on a matter because the broker has not received voting instructions from the beneficial owner, and (i) the broker does not have discretionary voting authority on the matter or (ii) the broker chooses not to vote on a matter for which it has discretionary voting authority. Pursuant to the New York Stock Exchange, which governs brokers’ use of discretionary authority, brokers are permitted to exercise discretionary voting authority only on “routine” matters when voting instructions have not been timely received from a beneficial owner.

The approval of the issuance of the rights and Contingent Subsidiary Securities in order to satisfy the requirements of Nasdaq Listing Rule 5635(c) is considered a non-routine matter. Brokers that hold your shares, therefore, do not have discretionary authority to vote your shares on this matter unless they receive instructions from you on this matter. There are no discretionary items on the agenda for the Special Meeting, therefore broker non-votes should not occur and uninstructed shares held by brokers will not be deemed voting power present at the Special Meeting, resulting in such shares being excluded for purposes of determining the existence of a quorum for the Special Meeting. Therefore, because the voting standard for Proposal No. 1 is based on a majority of the votes present virtually or by proxy at the Special Meeting, broker non-votes will have no effect.

3

| Q. | What constitutes a quorum at the Special Meeting? |

| A. | In accordance with Delaware law (the law under which we are incorporated) and our Second Amended and Restated Bylaws, the presence at the Special Meeting, by proxy or virtually in person, of the holders of a majority of the outstanding shares of the capital stock entitled to vote at the Special Meeting constitutes a quorum, thereby permitting the stockholders to conduct business at the Special Meeting. |

If a quorum is not present at the Special Meeting, a majority of the stockholders present virtually in person and by proxy may adjourn the meeting to another date. If an adjournment is for more than 30 days or a new record date is fixed for the adjourned meeting by our Board of Directors, we will provide notice of the adjourned meeting to each stockholder of record entitled to vote at the adjourned meeting. At any adjourned meeting at which a quorum is present, any business may be transacted that might have been transacted at the originally called Special Meeting.

| Q. | What vote is required for the approval of the issuance of the rights and Contingent Subsidiary Securities in order to satisfy the requirements of Nasdaq Listing Rule 5635(c)? |

| A. | The affirmative vote of a majority of the shares of the Company’s common stock present virtually in person or by proxy at the Special Meeting is required to approve Proposal No. 1 the issuance of the rights and Contingent Subsidiary Securities in order to satisfy the requirements of Nasdaq Listing Rule 5635(c). |

| Q. | What percentage of our outstanding common stock do our directors and executive officers own? |

| A. | As of the Record Date, our directors and executive officers owned, or have the right to acquire, approximately 28.5% of our outstanding common stock. See the discussion under the heading “Stock Ownership of Our Directors, Executive Officers, and 5% Beneficial Owners” on page for more details. |

| Q. | How can I find out the results of the voting of the Special Meeting? |

| A. | We will announce preliminary voting results at the Special Meeting. We will also disclose voting results on a Form 8-K filed with the SEC, within four business days of the Special Meeting. |

| Q. | Who is paying for this proxy solicitation? |

| A. | We will pay the entire cost of preparing, assembling, printing, mailing, and distributing these proxy materials and soliciting votes. If you choose to vote over the internet, you are responsible for internet access charges you may incur. If you choose to vote by telephone, you are responsible for telephone charges you may incur. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone or by electronic communication by our directors, officers and employees, who will not receive any additional compensation for such solicitation activities and also by our proxy solicitation firm who we have retained for that purpose. |

4

Summary Compensation Table

As determined in accordance with SEC rules, our “named executive officers” for purposes of this proxy statement are the five individuals set forth below. The following table sets forth information concerning compensation paid by the Company to its named executive officers for services rendered to it in all capacities during the years ended December 31, 2022, and December 31, 2021.

| Non-equity | ||||||||||||||||||||

| Incentive | All | |||||||||||||||||||

| Stock | Plan | Other | ||||||||||||||||||

| Salary | Bonus | Awards(1) | Compensation(2)(3) | Total | ||||||||||||||||

| Name and principal position(s) | Year | ($) | ($) | ($) | ($) | ($) | ($) | |||||||||||||

| Lindsay A. Rosenwald, M.D.(4) | ||||||||||||||||||||

| Chairman, President and | 2022 | $ | 62,655 | $ | __ | $ | 798,638 | $ | __ | $ | 880,123 | $ | 1,741,427 | |||||||

| Chief Executive Officer | 2021 | $ | 60,255 | — | 2,757,465 | — | 32,399 | 2,850,119 | ||||||||||||

| David Jin(5) | ||||||||||||||||||||

| Chief Financial Officer | 2022 | 338,500 | 52,500 | 1,053,000 | — | 21,682 | 1,465,682 | |||||||||||||

| 2021 | — | — | — | — | — | — | ||||||||||||||

| George Avgerinos, Ph.D. (6) | ||||||||||||||||||||

| Senior Vice President, | 2022 | 386,488 | — | — | — | — | 386,488 | |||||||||||||

| Biologics Operation | 2021 | 386,522 | 137,830 | — | — | — | 524,352 | |||||||||||||

| Michael S. Weiss(5) | ||||||||||||||||||||

| Executive Vice Chairman, | 2022 | 62,655 | __ | 798,638 | __ | 105,263 | 966,566 | |||||||||||||

| Strategic Development | 2021 | 60,255 | — | 2,757,465 | __ | 32,394 | 2,850,114 | |||||||||||||

| Robyn Hunter(7) | ||||||||||||||||||||

| Former Corporate Secretary | 2022 | 278,265 | — | 127,500 | — | 533 | 406,297 | |||||||||||||

| and Chief Financial Officer | 2021 | 396,194 | 158,262 | — | — | 852 | 555,308 | |||||||||||||

| (1) | Represents the aggregate grant date fair value computed in accordance with FASB Accounting Standards Codification Topic 718, Stock Compensation, as modified or supplemented (“FASB ASC Topic 718”). On January 1, 2023 and 2022, Dr. Rosenwald and Mr. Weiss were each awarded 1,219,294 and 1,102,986 shares, respectively, of restricted common stock of the Company (or one percent (1%) of the total outstanding shares of the Company) for their performance in 2022 and 2021, respectively. On October 26, 2022, Mr. Jin was awarded 1,350,000 Restricted Stock Units related to his appointment to Chief Financial Officer, and Ms. Hunter was awarded 125,000 Restricted Stock Units on August 29, 2022 for her continued service to the Company under a consulting agreement. |

| (2) | Under the LTIP (as defined below), each of Dr. Rosenwald and Mr. Weiss is eligible to receive, inter alia, a $500,000 annual cash bonus; in March 2023, the Compensation Committee reviewed the 2022 performance targets and approved a $500,000 cash bonus for each of Dr. Rosenwald and Mr. Weiss. Both Dr. Rosenwald and Mr. Weiss elected to forego and disclaim such cash bonus with respect to calendar year 2021. |

| (3) | All other compensation for 2022 for each of Dr. Rosenwald and Mr. Weiss includes long-term disability premiums and the grant date fair value of equity awards of 500,000 restricted shares in FBIO Acquisition Corp. XXI – L, respectively. Additionally, Dr. Rosenwald received 1,374,389 shares of Fortress’ common stock as a result of the vesting of restricted stock grants. All other compensation for 2021 for each of Dr. Rosenwald and Mr. Weiss includes long-term disability premiums and the grant date fair value of equity awards of 500,000 restricted shares in FBIO Acquisition Corp. XV, XVI, XVII, XVIII, XIX, XX and VIII, respectively. |

5

| (4) | Mr. Weiss received in his capacity as Chairman of the Board of Checkpoint Therapeutics, Inc. (“Checkpoint”) 4,761 restricted shares of common stock and $60,000 cash fees, and as Executive Chairman of Mustang Bio, Inc. 71,664 restricted shares of common stock and $60,000 cash fees. Dr. Rosenwald received 4,761 restricted shares of common stock and $50,000 cash fees from Checkpoint and 71,664 restricted shares of common stock and $50,000 cash fees from Mustang Bio, Inc. for his role on the Board of Directors of those companies for the year ended 2022. |

Mr. Weiss, in each case through a wholly-owned LLC Caribe BioAdvisors, LLC, received in his capacity as Chairman of the Board of Checkpoint 1,650 restricted shares of Checkpoint common stock (adjusted for Checkpoint’s 1-for-10 reverse stock split effective December 6, 2022) and $60,000 cash fees, and as Executive Chairman of Mustang Bio, Inc. 13,774 restricted shares of common stock and $60,000 cash fees. Dr. Rosenwald received 1,650 restricted shares of common stock and $50,000 cash fees from Checkpoint Therapeutics Inc. and 13,774 restricted shares of common stock and $50,000 cash fees from Mustang Bio, Inc. for his role on the Board of Directors of those companies for the year ended 2021.

| (5) | Effective August 16, 2022, Mr. Jin was appointed Chief Financial Officer for the Company. |

| (6) | For 2021 and 2022, Dr. Avgerinos’s salary and bonus was 100% reimbursed by TG Therapeutics, Inc. (“TGTX”) under the Shared Services Agreement. |

| (7) | Effective August 16, 2022, Ms. Hunter resigned as Chief Financial Officer for the Company. $196,130 of Ms. Hunter’s 2021 compensation was reimbursed by Journey Medical Corporation. |

Perquisites

From time to time, the Company has provided certain of the named executive officers with perquisites that the Board of Directors believes are reasonable. The Company does not view perquisites as a significant element of its comprehensive compensation structure, but does believe they can be useful in attracting, motivating and retaining the executive talent for which the Company competes. The Company believes that these additional benefits may assist executive officers in performing their duties and provide time efficiencies for executive officers in appropriate circumstances, and the Company may consider providing additional perquisites in the future. All future practices regarding perquisites will be approved and subject to periodic review by the Compensation Committee.

Summary of Material Components of Compensation Program

The Company believes in providing to its executive management team a competitive total compensation package featuring a combination of elements. The executive compensation programs are designed to achieve the following objectives:

| · | reward performance; |

| · | attract, motivate and retain executives of outstanding ability and potential; and |

| · | ensure that executive compensation is rationally related to building stockholder value. |

The Board of Directors believes that the Company’s executive compensation programs should include short- and long-term components, including cash and equity-based compensation, and should be oriented towards a merits-based metric that rewards consistent performance that meets or exceeds expectations.

Base Salaries

Base salaries for the Company’s executives are initially established through arm’s-length negotiation at the time the executive is hired, taking into account such executive’s qualifications, experience, prior salary, the scope of his or her responsibilities, and competitive market compensation paid by other companies for similar positions within the industry. Base salaries are reviewed annually, typically in connection with the annual performance review process, and adjusted from time to time to realign salaries with market levels after taking into account individual responsibilities, performance, and experience. While other of the Company’s executives are paid salaries typical within the industry for persons of their experience and expertise, Dr. Rosenwald and Mr. Weiss have elected to largely forego the payment of salary in exchange for participation in the merits-based programs described below.

Annual Discretionary Bonuses

In addition to the payment of base salaries, the Company believes that discretionary bonuses can play an important role in providing appropriate incentives to its executives to achieve the Company’s strategic objectives. As part of the annual performance reviews, the Compensation Committee reviews and analyzes each executive officer’s overall performance against such executive’s goals as identified by the Compensation Committee.

6

Long-Term Incentive Plan

The Fortress Biotech, Inc. Amended and Restated Long Term Incentive Plan (the “LTIP”) is designed to compensate Dr. Rosenwald and Mr. Weiss based on their responsibilities and for their contributions to the successful achievement of certain corporate goals and objectives of the Company and to share the success and risks of the Company based upon achievement of business goals. Eligible participants include Dr. Rosenwald, Mr. Weiss, or any limited liability company or limited partnership owned and controlled by Dr. Rosenwald or Mr. Weiss, provided such entity has a bona fide service provider relationship with the Company (“Eligible Entities” and together with Dr. Rosenwald and Mr. Weiss, the “LTIP Participants”).

On January 1 of each year, the LTIP entitles the Company to grant restricted shares of common stock of the Company to the LTIP Participants equal to up to one percent (1%) of the total outstanding shares of common stock of the Company, such actual amount to be based upon the achievement of the goals and objectives of each individual as set by the Compensation Committee for the preceding year. In the case of the LTIP Participants, such goals and objectives include, among other things, the Company’s in-licensing of new medical technologies of substantial promise, operational and cash management, the Company’s issuance of new debt securities, the Company’s achievement of developmental, regulatory and clinical milestones in respect of its in-licensed technologies, the recruitment and retention of personnel, share price performance, trading volume of the Company’s public securities, and the overall positioning of the Company within its relevant market.

Restricted shares granted under the LTIP are subject to repurchase by the Company until both of the following conditions are met: (i) the Company achieves a specified market capitalization milestone, and (ii) the employee is either in the service of the Company as an employee or as a Board member (or both) on the tenth anniversary of the LTIP, or the eligible employee has had an involuntary separation from service (as defined in the LTIP). The Company’s repurchase option on such shares will also lapse upon the occurrence of a corporate transaction (as defined in the LTIP) if the eligible employee is in service on the date of the corporate transaction.

In addition, pursuant to the LTIP, upon the formation of each new partner company of the Company, the LTIP Participants are to each receive five percent (5%) of the total outstanding shares of common stock of the partner company. Accordingly, in 2022, the LTIP Participants were each granted 500,000 shares of common stock of FBIO Acquisition Corps. XXI through L.

Pursuant to the LTIP, the LTIP Participants are also eligible for performance-based cash bonuses not to exceed an annual aggregate amount of $1,000,000. In March 2022, Dr. Rosenwald and Mr. Weiss each waived their rights to any cash bonus in connection with their performance for calendar year 2021. In March 2023, Dr. Rosenwald and Mr. Weiss again waived their rights to receive any cash bonus in connection with their performance for calendar year 2022.

Equity Incentive Compensation

The Company believes that by providing its executives the opportunity to increase their ownership of Company stock, the interests of its executives will be more closely aligned with the best interests of the Company’s stockholders, encouraging long-term performance. The stock awards enable the executive officers to participate in the appreciation of the value of the Company’s stock, while personally participating in the risks of business setbacks. The Company grants equity awards to its executives pursuant to the Fortress Biotech, Inc. 2013 Stock Incentive Plan, as amended (the “2013 Plan”).

While the Company has awarded stock options to the executive officers as incentives in the past, it more recently has awarded restricted stock or restricted stock units (“RSUs”) to its executives. These RSUs vest in equal annual installments over a period of several years.

7

OUTSTANDING EQUITY AWARDS AT 2022 FISCAL YEAR-END

The following table sets forth certain information regarding outstanding equity awards held by the Company’s named executive officers, in securities of the company, as of December 31, 2022.

| Equity | ||||||||||||||||||||

| Incentive | ||||||||||||||||||||

| Plan | ||||||||||||||||||||

| Number of | Market | Equity | Awards: | |||||||||||||||||

| Securities | Number of | Number of | Value of | Incentive | Market or | |||||||||||||||

| Underlying | Securities | Shares of | Shares or | Plan | Payout | |||||||||||||||

| Unexercised | Underlying | Option/ | Option/ | Units of | Units of | Awards: | Value of | |||||||||||||

| Options/ | Unexercised | Warrant | Warrant | Stock That | Stock That | Number or | Unearned | |||||||||||||

| Warrant | Options | Exercise | Expiration | Have Not | Have Not | Unearned | Shares | |||||||||||||

| Name | Exercisable (#) | Unexercisable (#) | Price ($) | Date | Vested (#) | Vested ($) | Shares (#) | ($) | ||||||||||||

| Lindsay A. Rosenwald, M.D. | 25,000 | — | $ | 1.370 | 10/05/2025 | 6,451,919 | $ | 4,226,007 | (1) | 714,607 | (2) | $ | 468,068 | (1) | ||||||

| 15,000 | — | 7.420 | 02/07/2023 | — | — | — | — | |||||||||||||

| George Avgerino, Ph.D. | 200,000 | — | 9.210 | 06/04/2023 | — | — | — | — | ||||||||||||

| Michael S. Weiss | 30,000 | — | 2.100 | 12/19/2023 | 6,451,919 | 4,226,607 | (1) | 6,102,511 | (3) | 3,997,145 | (1) | |||||||||

| David Jin (4) | — | — | — | — | — | — | 1,293,750 | 847,406 | ||||||||||||

| Robyn Hunter (5) | — | — | — | — | — | — | 62,500 | 40,938 | ||||||||||||

| (1) | Based on $0.655 per share, the closing price of our common stock on the Nasdaq Capital Market on December 31, 2022, the last trading day of the fiscal year. |

| (2) | Pursuant to the terms of Dr. Rosenwald’s Restricted Stock Issuance Agreement for 1,979,346 shares of restricted stock of the Company, as amended on December 15, 2022, two-thirds of the shares issued vested on December 19, 2022, and one-third of the shares shall vest when the Company achieves market capitalization of four times the market capitalization as of the date of such grant, but in no event earlier than December 19, 2024. |

| (3) | Pursuant to the terms of Mr. Weiss’ Restricted Stock Issuance Agreement for 1,979,346 shares of restricted stock of the Company, as amended on December 15, 2022, each one-third of the shares issued shall vest when the Company achieves market capitalization of two, three, and four times the market capitalization as of the date of such grant, but in no event earlier than December 19, 2024. Pursuant to the terms of Mr. Weiss’s 2014 Restricted Stock Issuance Agreement for 3,958,692 shares, as amended on December 15, 2017, February 7, 2020 and again on December 19, 2022: (i) 16.67% of the shares vested on February 20, 2015; (ii) 33.34% of the shares will vest on December 19, 2024; and (iii) 10% of the remainder of the aggregate amount of such shares will vest upon each closing by the Company of a corporate development transaction, provided that if any such corporate development transaction occurs prior to December 19, 2024, vesting of each such 10% of the remainder of the shares will occur on December 19, 2024, subject to Mr. Weiss’s continued employment with the Company. |

| (4) | Pursuant to the terms of Mr. Jin’s Restricted Stock Unit Award Agreement effective October 26, 2022 for 1,350,000 Restricted Stock Units (“Units”). The Units are unvested when granted, and vest pro rata on a monthly basis; vesting began on November 26, 2022 and will end on October 26, 2026, subject to Mr. Jin’s Continuous Service through the applicable vesting dates, provided that vesting may accelerate or cease as provided for in the Units Award Agreement or in the Company’s 2013 Stock Incentive Plan. |

| (5) | Effective August 16, 2022, Ms. Hunter resigned as Chief Financial Officer for the Company. Pursuant to the terms of Ms. Hunter’s Restricted Stock Unit Award agreement effective August 29, 2022, one-half of the units vested on September 1, 2022 and one-half of the units vest on January 1, 2023. |

8

Summary of Potential Payments Upon Termination of Employment or Change in Control

Dr. Rosenwald and Mr. Weiss

The Company has not entered into employment agreements with either of Dr. Rosenwald or Mr. Weiss. The Company’s repurchase option on restricted shares granted to Dr. Rosenwald, Mr. Weiss or related entities under the LTIP lapse upon the occurrence of a corporate transaction (as defined in the LTIP) if the eligible employee is in service on the date of the corporate transaction, or upon a termination of service other than a voluntary separation.

Ms. Hunter

The Company has not entered into an employment agreement with Ms. Hunter. Ms. Hunter resigned as Chief Financial Officer of the Company effective August 16, 2022.

Mr. Jin

David Jin, who has served as the Company’s Vice President of Corporate Development and the Interim Principal Executive Officer, Interim Principal Financial Officer, and Chief Operating Officer of the Company’s subsidiary Avenue Therapeutics, Inc., was appointed Chief Financial Officer effective August 16, 2022. The Company has not entered into an employment agreement with Mr. Jin.

Dr. Avgerinos

In June 2013, the Company entered into an employment agreement with Dr. Avgerinos, its Senior Vice President, Biologics Operations, which provides that if the Company terminates Dr. Avgerinos without cause or he resigns for good reason, he will be entitled to: (i) severance payments at a rate equal to his base salary then in effect for a period of 12 months following his termination date; (ii) a pro-rata share of the annual milestone bonus for the year in which the termination occurred, to be paid when and if such bonus would have been paid under the employment agreement, and (iii) accelerated vesting of any option shares that would have vested on the next anniversary date of their respective grant date. As of December 31, 2022, all shares under this grant were vested.

9

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth the indicated information as of December 31, 2022 with respect to our equity compensation plans:

| Number of | ||||||||||||

| Number of | Securities | |||||||||||

| Securities to be | Remaining | |||||||||||

| Issued Upon | Available for | |||||||||||

| Exercise of | Weighted- | Future Issuance | ||||||||||

| Outstanding | Average Exercise | Under Equity | ||||||||||

| Options, | Price of | Compensation | ||||||||||

| Restricted | Outstanding | Plans (Excluding | ||||||||||

| Stock Units, | Options, | Securities | ||||||||||

| Warrants and | Warrants and | Reflected in | ||||||||||

| Plan Category | Rights (a) | Rights | Column (a)) | |||||||||

| Equity compensation plan approved by shareholders | 12,289,009 | $ | 2.17 | 889,052 | ||||||||

| Equity compensation plan not approved by shareholders | — | — | — | |||||||||

| Total | 12,289,009 | $ | 2.17 | 889,052 | ||||||||

Our equity compensation plans consist of the Coronado Biosciences, Inc. 2012 Employee Stock Purchase Plan, the Fortress Biotech, Inc. 2007 Stock Incentive Plan, the Fortress Biotech, Inc. 2013 Stock Incentive Plan, as amended, and the Fortress Biotech, Inc. Long Term Incentive Plan, all of which were approved by our stockholders. We do not have any equity compensation plans or arrangements that have not been approved by our stockholders.

10

The following table shows the past two fiscal years’ total compensation for our named executive officers as set forth in the Summary Compensation Table, the “compensation actually paid” to our named executive officers (as determined under SEC rules), our total shareholder return (TSR), and our net income.

SEC rules require certain adjustments be made to the Summary Compensation Table totals to determine Compensation Actually Paid as reported in the Pay Versus Performance Table. Compensation Actually Paid does not necessarily represent cash and/or equity value transferred to the applicable named executive officer without restriction, but rather is a valuation calculated under applicable SEC rules. In general, Compensation Actually Paid is calculated as summary compensation table total compensation adjusted to (a) include the value of any pension benefit (or loss) attributed to the past fiscal year, including on account of any amendments adopted during such year; and (b) include the fair market value of equity awards as of December 31, 2022 or, if earlier, the vesting date (rather than the grant date) and factor in dividends and interest accrued with respect to such awards. For purposes of the disclosure below, no pension valuation adjustments were required.

| Year | Summary Compensation Table Total for Principal Executive Officer (“PEO”)(1) | Compensation Actually Paid to PEO(2)(3) | Average Summary Compensation Table Total for Non-PEO Named Executive Officers (“NEOs”)(4) | Average Compensation Actually Paid to Non- PEO NEOs(4) | Value of Initial Fixed $100 Investment Based on Total Shareholder Return (“TSR”)(5) | Net Income (Loss) (millions)(6) | |||||||||||||||||||

| 2022 | $ | 1,741,427 | $ | (11,892,328 | ) | $ | 946,182 | $ | (5,698,806 | ) | $ | 21 | $ | (76.3 | ) | ||||||||||

| 2021 | 2,850,119 | (1,293,340 | ) | 1,309,924 | (736,904 | ) | 79 | (64.7 | ) | ||||||||||||||||

(1) Dr. Rosenwald was the Registrant’s PEO for each of the 2022 and 2021 fiscal years.

(2) The amounts disclosed reflect the adjustments listed in the tables below to the amounts reported in the Summary Compensation Table for PEO:

| Year | Less: Grant Date Value of Equity Awards | Plus: Change in Value of Awards Granted During the Current Year | Plus: Vesting Date Value of Awards that Vested During the Year | Plus: Year-Over- Year Change in Fair Value of Unvested Awards | Plus: Change in Value of Awards Vesting During the Current Year | Dividends on Unvested Awards | Total Adjustments | ||||||||||||||||||||||

| 2022 | $ | (798,638 | ) | $ | 798,638 | $ | - | $ | (10,972,643 | ) | $ | (2,661,111 | ) | $ | - | $ | (13,633,754 | ) | |||||||||||

| 2021 | (2,757,465 | ) | 2,757,465 | - | (4,166,485 | ) | 23,026 | - | (4,143,459 | ) | |||||||||||||||||||

(3) For 2022 and 2021 fiscal years, the grant date and fair value date for the current year equity awards were equivalent due to the awards being granted as of the end of the year.

(4) For the 2022 fiscal year, our Non-PEO NEOs were: David Jin, George Avgerinos and Michael S. Weiss. For the 2021 fiscal year, our Non-PEO NEOs were: Robyn Hunter, George Avgerinos and Michael S. Weiss. The amounts disclosed reflect the adjustments listed in the tables below to the amounts reported in the Summary Compensation Table for Non-PEO NEOs:

| Year | Less: Grant Date Value of Equity Awards | Plus: Change in Value of Awards Granted During the Current Year | Plus: Vesting Date Value of Awards that Vested During the Year | Plus: Year-Over- Year Change in Fair Value of Unvested Awards | Plus: Change in Value of Awards Vesting During the Current Year | Dividends on Unvested Awards | Total Adjustments | ||||||||||||||||||||||

| 2022 | $ | (659,713 | ) | $ | 562,327 | $ | 17,741 | $ | (6,565,343 | ) | $ | - | $ | - | $ | (6,644,987 | ) | ||||||||||||

| 2021 | (919,155 | ) | 919,155 | 91,000 | (2,137,829 | ) | - | - | (2,046,829 | ) | |||||||||||||||||||

(5) Calculated by dividing the sum of the cumulative amount of dividends for the measurement period, assuming dividend reinvestment, and the difference between the share price of our common stock at the end and the beginning of the measurement period by the share price of our common stock at the beginning of the measurement period.

(6) The dollar amounts reported represent the amount of net income (loss) reflected in our consolidated audited financial statements for the applicable year.

Analysis of the Information Presented in the Pay Versus Performance Table

11

Compensation Actually Paid and Net Income (Loss)

Due to the nature of our Company’s consolidated financials and primary focus on research and development of novel therapies, our company has not historically utilized net income (loss) as a performance measure for our executive compensation program. From 2021 to 2022, our net loss increased and the Compensation Actually Paid our PEO and Non-PEO NEOs also decreased between those years.

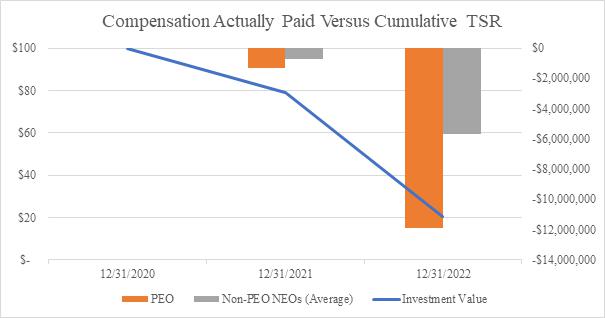

PEO and Non-PEO NEO Compensation Actually Paid and Company Total Shareholder Return (“TSR”)

The following chart sets forth the relationship between Compensation Actually Paid to our PEO, the average of Compensation Actually Paid to our Non-PEO NEOs, and the Company’s TSR over the period covering fiscal years 2021 and 2022. A large component of our executive compensation is equity-based to align compensation with performance, but also includes other appropriate incentives such as cash bonuses that are designed to incentivize our executives to achieve annual corporate goals. We believe the equity-based compensation strongly aligns our PEO and Non-PEO NEOs’ interests with those of our shareholders to maximize long-term value and encourages long-term employment.

All information provided above under the “Pay Versus Performance” heading will not be deemed to be incorporated by reference in any filing of our company under the Securities Act of 1933, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

12

In October 2010, the Board of Directors adopted a compensation program for its non-employee directors, or the Non-Employee Director Compensation Policy. Pursuant to the Non-Employee Director Compensation Policy, each member of the Board who is not a Company employee and who is not otherwise receiving compensation from the Company pursuant to another arrangement, will receive an annual cash retainer of $30,000, payable quarterly, and may receive an initial stock option, restricted stock or restricted stock unit grant for shares of the Company’s common stock. Any such initial stock option, restricted stock or restricted stock unit grant will vest in three annual installments. In July 2011, the Non-Employee Director Compensation Policy was modified to include additional fees for committee participation whereby committee members and committee chairs will receive additional annual cash retainers of $5,000 and $10,000, respectively, payable quarterly. In addition, members may annually receive a restricted stock or restricted stock unit grant for (i) up to 50,000 shares of the Company’s common stock for service on the Board and (ii) up to 50,000 shares of the Company’s common stock for service on the Strategic Transaction Committee. Beginning in 2012, Audit Committee members and chairs receive additional annual cash retainers of $7,500 and $15,000, respectively, payable quarterly.

The following table and related footnotes show the compensation paid to or accrued for the benefit of the Company’s non-employee directors in the fiscal year ended December 31, 2022.

| Fees Earned | Stock | All Other | ||||||||||||||

| or Paid in | Awards(2) | Compensation | Total | |||||||||||||

| Name | Cash(1)($) | ($) | ($) | ($) | ||||||||||||

| Jimmie Harvey, Jr., M.D. | $ | 47,500 | $ | 250,000 | (3) | $ | — | $ | 297,500 | |||||||

| Malcolm Hoenlein | 35,000 | 125,000 | (3) | — | 160,000 | |||||||||||

| Dov Klein, CPA | 100,000 | 250,000 | (4) | — | 350,000 | |||||||||||

| J. Jay Lobell | 67,500 | 250,000 | — | 317,500 | ||||||||||||

| Kevin L. Lorenz, J.D. | 30,000 | 125,000 | — | 155,000 | ||||||||||||

| Eric K. Rowinsky, M.D. | 35,000 | 250,000 | (3) | 194,250 | (5) | 479,250 | ||||||||||

| Lucy Lu, M.D. | — | 17,400 | 558,872 | (6) | 576,272 | |||||||||||

| (1) | Represents director and committee fees paid for or accrued in 2022. |

| (2) | On January 1, 2022 the Company granted shares of its common stock to certain directors for their service on the Board of Directors and additionally, in the case of Messrs. Lobell and Klein and Drs. Harvey and Rowinsky, for their service on the Strategic Transaction Committee, pursuant to Restricted Stock Issuance Agreements. Dr. Lu's grant corresponds to her appointment to the Board of Directors in December 2022. The shares vest one-third on each of the first three anniversaries of the date of grant, subject to certain restrictions. The Company retains the right to repurchase unvested shares as specified in the agreements. Amounts listed represent the aggregate fair value amount computed as of the grant date of each award during 2022 in accordance with FASB ASC Topic 718. |

| (3) | In 2022, Drs. Harvey and Rowinsky, and Mr. Hoenlein elected to defer 100% of the value of their stock awards. This amount was credited to each of their deferred compensation accounts, respectively. |

| (4) | In 2022, Mr. Klein elected to defer 80% of the value of his stock award. This amount was credited to his deferred compensation account. |

| (5) | In 2022, Dr. Rowinsky received $194,250 in compensation for consulting services provided to the Company. | |

| (6) | Dr. Lu served as the Chief Executive Officer of the Company’s subsidiary, Avenue Therapeutics, Inc. (“Avenue”), from July 2017 until March 2022. In her role as Chief Executive Officer of Avenue, Dr. Lu received $558,872 in total compensation in 2022.

|

Non-Qualified Deferred Compensation

On March 12, 2015, the Compensation Committee of the Board approved a deferred compensation plan (the “Plan”) for non-employee directors (“Participants”). The Plan is administered by the Compensation Committee and intended to be a non-qualified benefit plan for purposes of the Employee Retirement Income Security Act of 1974, as amended.

13

Pursuant to the Plan, a Participant can defer all or a portion of Participant’s unearned annual fees, meeting fees and committee fees, including restricted stock and restricted stock units. Deferred cash compensation will be converted into a number of stock units, determined based upon the closing price of the Company’s common stock on the date such fees would otherwise have been payable and placed into the Participant’s deferred compensation account (“Account”). Deferred restricted stock unit grants will be converted on a share-for-share basis on the date such restricted stock units would otherwise have been payable and placed into the Participant’s Account.

On the tenth business day of January of the year following the Participant’s termination of service on the Board due to resignation, removal, failure to be re-elected or retirement, the amount of deferred compensation in the Participant’s Account will be distributed to the Participant in a lump sum payment of a number of shares of the Company’s common stock under the Plan equal to the number of whole stock units in the Account and cash in lieu of any fractional shares. Distributions from the Account may be accelerated in the event of the Participant’s death or upon a corporate transaction (as defined in the Plan).

14

STOCK OWNERSHIP OF OUR DIRECTORS, EXECUTIVE OFFICERS, AND 5% BENEFICIAL OWNERS

The following table shows information, as of the Record Date, concerning the beneficial ownership of our common stock by:

| ● | each person we know to be the beneficial owner of more than 5% of our common stock; |

| ● | each of our current directors; |

| ● | each of our Named Executive Officers (“NEOs”) ; and |

| ● | all current directors and NEOs as a group. |

As of the Record Date, there were 113,441,964 shares of our common stock outstanding. In order to calculate a specific stockholder’s percentage of beneficial ownership, we include in that stockholder’s calculation those shares underlying options or warrants beneficially owned by that stockholder that are vested or that will vest within 60 days of the Record Date. Shares of restricted stock are deemed to be outstanding. Options or warrants held by other stockholders that are not attributed to the named beneficial owner are disregarded in this calculation. Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the shares of our common stock. Unless we have indicated otherwise, each person named in the table below has sole voting power and investment power for the shares listed opposite such person’s name, except to the extent authority is shared by spouses under community property laws.

| Name and Address of Beneficial Owner | Shares Owned | Shares Under Exercisable Options and Unvested Restricted Stock Units(1) | Total Shares Beneficially Owned | Percentage Beneficially Owned | ||||||||||||

| 5% or Greater Stockholder: | ||||||||||||||||

| Directors and Named Executive Officers: | ||||||||||||||||

| Lindsay A. Rosenwald, M.D. (2) | 12,953,882 | 40,000 | 12,993,882 | 11.5 | % | |||||||||||

| Michael S. Weiss | 13,554,430 | 30,000 | 13,584,430 | 12.0 | % | |||||||||||

| J. Jay Lobell | 1336,000 | 70,000 | 1,406,000 | 1.2 | % | |||||||||||

| David Jin (3) | 109,079 | 1,293,750 | 1,402,829 | 1.2 | % | |||||||||||

| Eric K. Rowinsky, M.D. | 720,000 | 223,490 | 943,490 | * | % | |||||||||||

| George C. Avgerinos, Ph.D.(4) | 655,170 | 200,000 | 855,170 | * | % | |||||||||||

| Lucy Lu, M.D. (5) | 121,403 | — | 121,403 | * | % | |||||||||||

| Robyn Hunter (6) | 199,294 | 62,500 | 261,794 | * | % | |||||||||||

| Jimmie Harvey, Jr., M.D. | 50,000 | 70,000 | 120,000 | * | % | |||||||||||

| Dov Klein, CPA (7) | 211,015 | — | 211,015 | * | % | |||||||||||

| Malcolm Hoenlein | 85,636 | — | 85,636 | * | % | |||||||||||

| Kevin L. Lorenz, J.D. | 324,572 | — | 324,572 | * | % | |||||||||||

| All current executive officers (including NEOs) and directors as a group (12 persons) | 30,320,481 | 1,989,740 | 32,310,221 | 28.5 | % | |||||||||||

* Less than 1%

| (1) | Includes only options exercisable within 60 days of February 9, 2023 and unvested restricted stock units. |

| (2) | Includes 12,040,038 shares held directly by Dr. Rosenwald, 170,983 shares held by Capretti Grandi, LLC, and 742,861 shares held by Paramount Biosciences, LLC (“PBS”). Dr. Rosenwald has voting and dispositive control over the shares held by Capretti Grandi, LLC and PBS. Does not include (i) 453,822 shares of common stock held by the LAR Family Trusts, or (ii) 1,000,000 shares of common stock held by state trusts established for the benefit of Dr. Rosenwald’s family, over which Dr. Rosenwald does not have any voting or dispositive control. |

| (3) | Mr. Jin was appointed Chief Financial Officer of the Company effective August 16, 2022. |

| (4) | Includes 200,000 options reinstated on April 17, 2019. |

| (5) | Dr. Lu was appointed as Director to the Company’s Board of Directors effective December 14, 2022. |

| (6) | Effective August 16, 2022, Ms. Hunter resigned as Chief Financial Officer for the Company. |

| (7) | Includes 1,800 shares of common stock held by Mr. Klein’s spouse. |

15

PROPOSAL

ONE: APPROVAL TO ISSUE RIGHTS TO ACQUIRE CONTINGENT SUBSIDIARY

SECURITIES IN CERTAIN SUBSIDIARIES IN ORDER TO SATISFY THE REQUIREMENTS

OF NASDAQ LISTING RULE 5635(C)

Approval of Contingent Subsidiary Securities Issuances

Our common stock is listed on the Nasdaq Capital Market, and, as such, we are subject to the Nasdaq Listing Rules, including Nasdaq Listing Rule 5635. Listing Rule 5635(c) requires shareholder approval for a sale of securities in a transaction (other than a public offering) at a discount to the market value to officers, directors, employees, or consultants. As set forth below, we sold Contingent Subsidiary Securities to the Interested Directors and Officers (defined below) at a price less than the market value. Accordingly, in order to comply with the Nasdaq Listing Rules, specifically 5635(c), we are seeking stockholder approval of this Proposal No. 1.

Registered Offering

On February 7, 2023, we entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”) with each of several institutional and accredited investors (the “Investors”), pursuant to which we agreed to issue and sell an aggregate of 16,642,894 shares (the “Shares”) of common stock, at a price per Share of $0.835 (the “Registered Direct Offering”). The Shares were offered and sold pursuant to the Company’s effective registration statement on Form S-3 (Registration No. 333-258145), which was declared effective by the Securities and Exchange Commission on July 30, 2021, the base prospectus included therein and a prospectus supplement (the “Prospectus Supplement”) related to the Registered Direct Offering dated February 7, 2023. The Registered Direct Offering closed on February 10, 2023.

Sale of Contingent Subsidiary Securities

In connection with the closing of the sale the Shares in the Registered Direct Offering, on February 7, 2023, we also entered into a Letter Agreement (the “Letter Agreement”) with the Investors for a concurrent private placement offering (“Private Placement” and together with the Registered Direct Offering, the “Offering), in which we agreed to issue rights to acquire Contingent Subsidiary Securities in certain subsidiaries to the Investors for nominal consideration, but contingent on stockholder approval of this Proposal No. 1. The Company may in the future arrange for the consummation of a CDT between a third-party licensor/seller, on the one hand, and, on the other hand, either one or more of its existing subsidiaries or one or more new subsidiaries incorporated by the Company after the date of the Letter Agreement for purposes of acquiring a Product Candidate (collectively, the “Designated Subsidiaries”), up to 20 Designated Subsidiaries. As used herein, (“CDT”) or “Corporate Development Transaction” means the first (and only the first) acquisition, designated as such by the Company in its sole discretion, by a given Designated Subsidiary of intellectual property rights (via license, asset purchase, stock purchase, merger or otherwise) pertaining to a biopharmaceutical technology, product, product candidate, medical device or compound (a “Product Candidate”). Therefore, concurrently with the closing of the sale of the Shares in the Offering, pursuant to the Letter Agreement we agreed to provide to each Investor rights to acquire ten-year warrants, in each case at an exercise price equal to the Fair Market Value (as defined in each Contingent Subsidiary Security) of one Designated Subsidiary Share (as defined below) on the date of the Corporate Development Transaction (each, a “Contingent Subsidiary Security” and collectively the “Contingent Subsidiary Securities”), to purchase shares of common stock of each Designated Subsidiary equal to the Aggregate Warrant Percentage (as defined below) of the total outstanding shares of common stock of that Designated Subsidiary (the “Designated Subsidiary Shares”), determined on an issued and outstanding, as-converted into common stock basis, as of the date of the Letter Agreement for existing Designated Subsidiaries or as of the date of incorporation (the date the articles of incorporation or applicable documents are filed with the secretary of state or similar government body) for Designated Subsidiaries that are incorporated after the date of Letter Agreement. A holder of the Contingent Subsidiary Securities also will have the right to exercise its Contingent Subsidiary Securities on a cashless basis. As used herein, the “Aggregate Warrant Percentage” shall mean a maximum of 3.474%. Each Investor under the Securities Purchase Agreement shall be entitled to a warrant to purchase only up to their pro-rata share of the Aggregate Warrant Percentage in the Designated Subsidiary Shares calculated as follows: the total purchase price paid by an Investor for the Shares purchased under the Securities Purchase Agreement, divided by the total aggregate purchase price paid by all Investors for the Shares purchased under the Securities Purchase Agreement, and then multiplying the resulting fraction by 3.474%.

16

Each Contingent Subsidiary Security will be exercisable with respect to a given Designated Subsidiary that has consummated a CDT for a period of ten (10) years from the issuance date of the Contingent Subsidiary Security. The issuance of the Contingent Subsidiary Securities will not occur until the consummation of a CDT and the Fair Market Value of the Designated Subsidiary Shares is determined by the Company, in its sole discretion, which Fair Market Value determination shall be binding upon all parties. The Company will notify the Investors in writing at the time of each such CDT consummation and again at the time the Fair Market Value determination for the Designated Subsidiary Shares is made for each Designated Subsidiary. Notwithstanding the foregoing or any other provision herein, once twenty (20) of the Designated Subsidiaries have consummated CDTs, or five years have elapsed from the date of the closing of the Registered Direct Offering, whichever is sooner, rights to future Contingent Subsidiary Securities shall immediately be extinguished and canceled, and the Investors shall have no further rights to acquire new Contingent Subsidiary Securities other than any Contingent Subsidiary Securities that have been previously issued. For clarity, in each case subject to the other provisions of the Letter Agreement, (1) all the Investors may obtain up to the Aggregate Warrant Percentage of the total outstanding shares in an aggregate of twenty (20) Designated Subsidiaries that have consummated a CDT, at which point all remaining rights to acquire Contingent Subsidiary Securities will be terminated, and (2) the Company retains sole discretion whether to arrange for a CDT (thereby incurring the obligation to issue Contingent Subsidiary Securities, and therefore Designated Subsidiary Shares upon a Contingent Subsidiary Security exercise, subject to the limitations herein) or to arrange for the acquisition of a Product Candidate by a separate, existing subsidiary or partner of the Company in a non-CDT transaction (i.e., not a Designated Subsidiary).

The Company received net proceeds of approximately $13.2 million from the Registered Direct Offering and sale of Contingent Subsidiary Securities, based on the offering price of $0.835 per share of common stock, after deducting estimated offering expenses. The Company intends to use the net proceeds for our operations, including, but not limited to, general corporate purposes, which may include research and development expenditures, clinical trial expenditures, manufacture and supply of product, and working capital. The timing and amount of our actual expenditures will depend on several factors. As of the date of this proxy statement, we cannot specify with certainty all of the particular uses for the net proceeds; accordingly, our management will have broad discretion in the application of proceeds.

Effect of Issuance on Existing Shareholders

We do not expect the issuance of the rights to acquire the Contingent Subsidiary Securities to have an effect on the rights of existing shareholders of the Company.

Contingent Subsidiary Securities Subject to Shareholder Action

The material features of the Contingent Subsidiary Securities are set forth above in the section captioned “Sale of Contingent Subsidiary Securities” and the Interested Directors and Officers that purchased the Contingent Subsidiary Securities are set forth below under the section captioned “Interests of Directors and Executive Officers.” The benefits or amounts that will be received by or allocated to each of the Interested Directors and Officers by virtue of their purchase of the Contingent Subsidiary Securities is not determinable at this time, and until the consummation of a CDT and the Fair Market Value of the Designated Subsidiary Shares is determined by the Company.

Stockholder Approval Pursuant to Nasdaq Listing Rule 5635(c)

We seek your approval of this Proposal No. 1 in order to satisfy the requirements of Nasdaq Listing Rule 5635(c) with respect to the issuance of the rights to acquire the Contingent Subsidiary Securities. A sale of securities in a transaction (other than a public offering) at a discount to the market value to the Company’s officers, directors, employees, or consultants requires shareholder approval under Listing Rule 5635(c) because it is considered a form of equity compensation. We are selling the Contingent Subsidiary Securities for nominal consideration in the Offering, and therefore not at market value, and the Interested Directors and Officers are participating as Investors in the Offering.

Until such stockholder approval is received, no Contingent Subsidiary Securities (or rights to acquire them) will be issued. The approval of this proposal at the special meeting would constitute such approval for purposes of Nasdaq Listing Rule 5635(c).

17

Effects if Proposal No. 1 Is Not Approved

Unless stockholder approval of this Proposal No. 1 is received, no Contingent Subsidiary Securities (or rights to acquire them) will be issued. If the Investors do not receive the rights to acquire the Contingent Subsidiary Securities, they may be inclined not to participate in future Company financings, which may cause us not to be able to obtain the most favorable terms for such offerings. Any inability to obtain future financings on sufficiently favorable terms may have a material adverse effect on our business, results of operations and financial condition.

Interests of Directors and Executive Officers

The Company’s Chairman, President and Chief Executive Officer, Lindsay A. Rosenwald, M.D., Director and Executive Vice Chairman, Strategic Development, Michael S. Weiss, Chief Financial Officer, David Jin, and Directors, J. Jay Lobell, Lucy Lu and Eric Rowinsky (collectively the “Interested Directors and Officers”) may have a substantial interest, directly or indirectly in the matter set forth by this Proposal No. 1 by virtue of their purchase of the Contingent Subsidiary Securities in the Offering. The Offering, including the participation by the Interested Directors and Officers, were approved by the disinterested members of our Board of Directors. As of the Record Date for the Special Meeting, the Interested Directors and Officers own 32,310,221 shares of the Company’s common stock, or 28.5 % shares of the Company’s common stock outstanding as of the Record Date. The Interested Directors and Officers may vote all such shares of the Company’s common stock on this Proposal No. 1. The Interested Directors and Officers will not vote any shares of common stock acquired after the Record Date, including the Shares acquired in the Offering. None of the Company’s other directors or executive officers have any substantial interest, directly or indirectly, in the matters set forth in this Proposal No. 1 except to the extent of their ownership of shares of the Company’s common stock.

THE BOARD RECOMMENDS A VOTE “FOR” APPROVAL OF THE ISSUANCE OF RIGHTS TO ACQUIRE THE CONTINGNET SUBSIDIARY SECURITIES. THE AFFIRMATIVE VOTE OF THE MAJORITY OF SHARES PRESENT IN PERSON OR BY PROXY AT THE MEETING AND ENTITLED TO VOTE ON THE SUBJECT MATTER IS REQUIRED FOR APPROVAL.

18

Householding of Special Meeting Materials

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of our proxy statement may have been sent to multiple stockholders in your household. We will promptly deliver a separate copy of either document to you if you contact us at: Fortress Biotech, Inc., 1111 Kane Concourse Suite 301, Bay Harbor Islands, FL 33154, Attn: David Jin. You may also contact us at (781) 652-4500.

If you want to receive separate copies of the proxy statement in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker, or other nominee record holder, or you may contact us at the above address or phone number.

Stockholder Proposals for Our 2023 Annual Meeting

The following information is being provided with respect to proposals to be brought for our upcoming 2023 annual meeting of stockholders.

Only proper proposals under Rule 14a-8 of the Exchange Act of 1934, as amended, which are timely received will be included in the proxy materials for our next annual meeting. In order to be considered timely, such proposal must have been received by our General Counsel and Corporate Secretary, Sam Berry, at 1111 Kane Concourse Suite 301, Bay Harbor Islands, FL 33154, no later than December 30, 2022. We suggest that stockholders submit any stockholder proposal by certified mail, return receipt requested.

Our Second Amended and Restated Bylaws require stockholders to provide advance notice to the Company of any stockholder director nomination(s) and any other matter a stockholder wishes to present for action at an annual meeting of stockholders (other than matters to be included in our proxy statement, which are discussed in the previous paragraph). In order to properly bring business before an annual meeting, our Second Amended and Restated Bylaws require, among other things, that the stockholder submit written notice thereof complying with our Second Amended and Restated Bylaws to Sam Berry, our General Counsel and Corporate Secretary, at the above address, not less than 45 days nor more than 75 days prior to the anniversary of the mailing of the preceding year’s proxy materials. Therefore, the Company must receive notice of a stockholder proposal submitted other than pursuant to Rule 14a-8 (as discussed above) no sooner than February 13, 2023, and no later than March 15, 2023. If a stockholder fails to provide timely notice of a proposal to be presented at our 2023 Annual Meeting of Stockholders, the proxy designated by our Board will have discretionary authority to vote on any such proposal that may come before the meeting.

In addition to satisfying the foregoing requirements under the Company’s bylaws, to comply with the universal proxy rules (once effective), shareholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than April 22, 2023.

Other Matters

Our Board does not know of any other matters that may come before the meeting. However, if any other matters are properly presented to the meeting, it is the intention of the person named in the accompanying proxy card to vote, or otherwise act, in accordance with their judgment on such matters.

Solicitation of Proxies

We will bear the cost of solicitation of proxies. In addition to the solicitation of proxies by mail, our officers and employees may solicit proxies in person or by telephone. We may reimburse brokers or persons holding stock in their names, or in the names of their nominees, for their expenses in sending proxies and proxy material to beneficial owners. Additionally, the Company has retained Alliance Advisors, LLC (“Alliance Advisors”) a proxy solicitation firm, which may solicit proxies on the Board’s behalf. The Company estimates that it will pay Alliance Advisors a fee of $12,000 for its services plus reimbursement of customary disbursements and expenses. Alliance Advisors expects that 2 of its solicitors will assist in the solicitation.

19

FORTRESS BIOTECH, INC. ATTN: DAVID JIN 1111 KANE CONCOURSE SUITE 301 BAY HARBOR ISLANDS, FL 33154 SCAN TO VIEW MATERIALS & VOTE VOTE BY INTERNET Before The Meeting - Go to www.proxyvote.com or scan the QR Barcode above Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time on April 9, 2023. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. During The Meeting - Go to www.virtualshareholdermeeting.com/FBIO2023SM You may attend the meeting via the Internet and vote during the meeting. Have the information that is printed in the box marked by the arrow available and follow the instructions. VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time on April 9, 2023. Have your proxy card in hand when you call and then follow the instructions. VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: D98540-S62601 KEEP THIS PORTION FOR YOUR RECORDS THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. DETACH AND RETURN THIS PORTION ONLY FORTRESS BIOTECH, INC. The Board of Directors recommends you vote FOR Proposal 1: For Against Abstain 1. Approval to Issue Rights to Acquire Contingent Subsidiary Securities in Certain Subsidiaries in Order to Satisfy the Requirements of NASDAQ Listing Rule 5635(c). NOTE: In its discretion, the proxy is authorized to vote upon such other business as may properly come before the Special Meeting. This proxy when properly executed will be voted as directed herein by the undersigned stockholder. If no direction is made, this proxy will be voted FOR proposal 1. Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer. Signature [PLEASE SIGN WITHIN BOX] Date Signature (Joint Owners) Date