CORPORATE PRESENTATION January 2020 Fortress Biotech FREE WRITING PROSPECTUS Filed Pursuant to Rule 433 Registration No. 333 - 226089 January 27, 2020

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates . Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering . You may get these documents for free by visiting EDGAR on the SEC Web site at www . sec . gov . Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by emailing info@fortressbiotech . com . 2

Forward Looking Statements This presentation may contain “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 and Section 21 E of the Securities Exchange Act of 1934 , as amended . As used below and throughout this presentation, the words “we”, “us” and “our” may refer to Fortress individually or together with one or more partner companies, as dictated by context . Such statements include, but are not limited to, any statements relating to our growth strategy and product development programs and any other statements that are not historical facts . Forward - looking statements are based on management’s current expectations and are subject to risks and uncertainties that could negatively affect our business, operating results, financial condition and stock price . Factors that could cause actual results to differ materially from those currently anticipated include : risks related to our growth strategy ; risks relating to the results of research and development activities ; our ability to obtain, perform under and maintain financing and strategic agreements and relationships ; uncertainties relating to preclinical and clinical testing ; our dependence on third party suppliers ; our ability to attract, integrate, and retain key personnel ; the early stage of products under development ; our need for and continued access to additional funds ; government regulation ; patent and intellectual property matters ; competition ; as well as other risks described in our SEC filings . We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward looking statements contained herein to reflect any change in our expectations or any changes in events, conditions or circumstances on which any such statement is based, except as may be required by law . The information contained herein is intended to be reviewed in its totality, and any stipulations, conditions or provisos that apply to a given piece of information in one part of this presentation should be read as applying mutatis mutandis to every other instance of such information appearing herein . 3

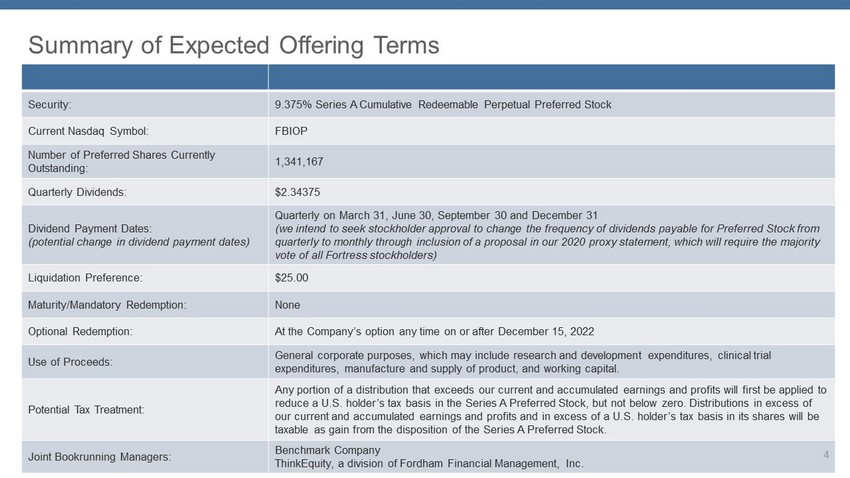

Summary of Expected Offering Terms Security: 9.375% Series A Cumulative Redeemable Perpetual Preferred Stock Current Nasdaq Symbol: FBIOP Number of Preferred Shares Currently Outstanding: 1,341,167 Quarterly Dividends: $2.34375 Dividend Payment Dates: (potential change in dividend payment dates) Quarterly on March 31, June 30, September 30 and December 31 (we intend to seek stockholder approval to change the frequency of dividends payable for Preferred Stock from quarterly to monthly through inclusion of a proposal in our 2020 proxy statement, which will require the majority vote of all Fortress stockholders) Liquidation Preference: $25.00 Maturity/Mandatory Redemption: None Optional Redemption: At the Company’s option any time on or after December 15, 2022 Use of Proceeds: General corporate purposes, which may include research and development expenditures, clinical trial expenditures, manufacture and supply of product, and working capital. Potential Tax Treatment: Any portion of a distribution that exceeds our current and accumulated earnings and profits will first be applied to reduce a U.S. holder’s tax basis in the Series A Preferred Stock, but not below zero. Distributions in excess of our current and accumulated earnings and profits and in excess of a U.S. holder’s tax basis in its shares will be taxable as gain from the disposition of the Series A Preferred Stock. Joint Bookrunning Managers: Benchmark Company ThinkEquity , a division of Fordham Financial Management, Inc. 4

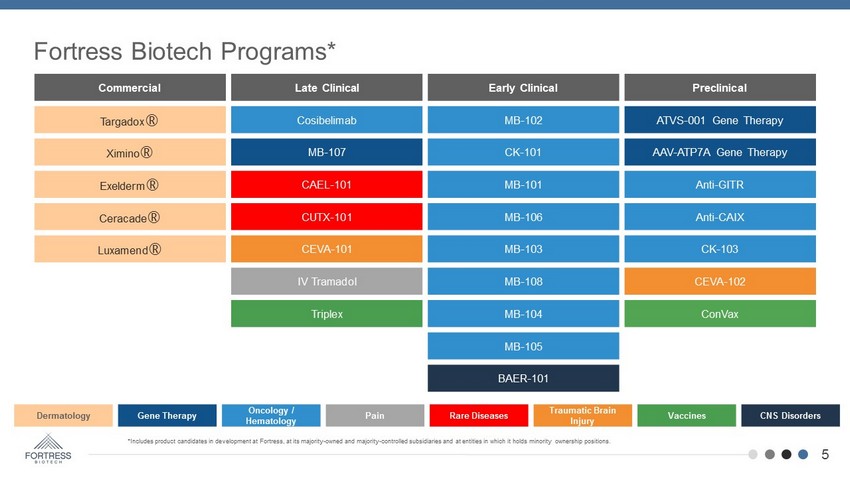

Commercial Late Clinical Early Clinical Preclinical Targadox ® Cosibelimab MB - 102 ATVS - 001 Gene Therapy Ximino ® MB - 107 CK - 101 AAV - ATP7A Gene Therapy Exelderm ® CAEL - 101 MB - 101 Anti - GITR Ceracade ® CUTX - 101 MB - 106 Anti - CAIX Luxamend ® CEVA - 101 MB - 103 CK - 103 IV Tramadol MB - 108 CEVA - 102 Triplex MB - 104 ConVax MB - 105 BAER - 101 Fortress Biotech Programs* *Includes product candidates in development at Fortress, at its majority - owned and majority - controlled subsidiaries and at entit ies in which it holds minority ownership positions. 5 Dermatology Gene Therapy Oncology / Hematology Pain Rare Diseases Traumatic Brain Injury Vaccines CNS Disorders

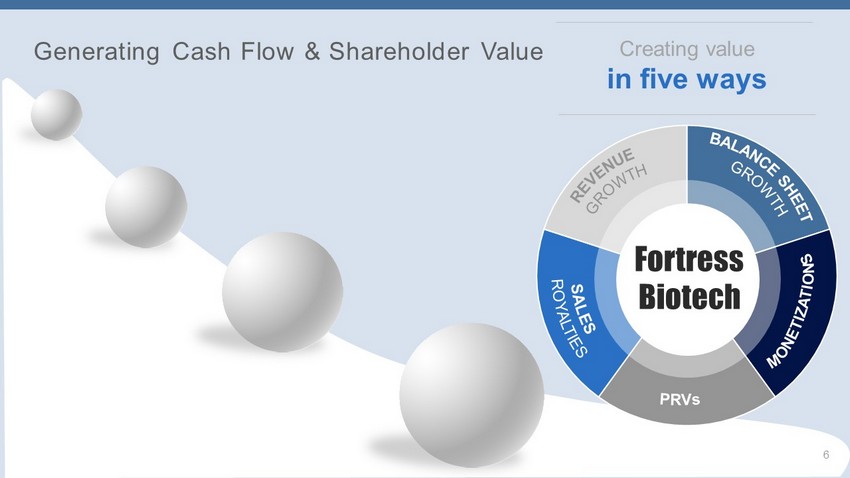

Generating Cash Flow & Shareholder Value 6 Creating value in five ways Fortress Biotech

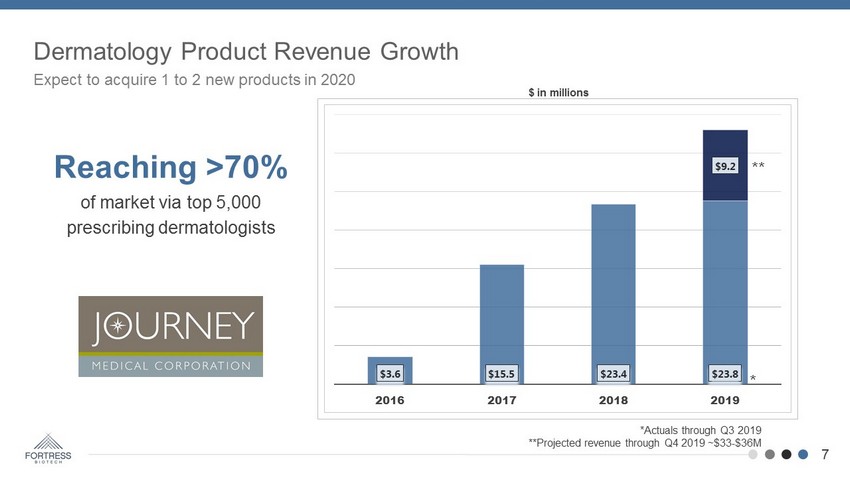

Dermatology Product Revenue Growth 7 Expect to acquire 1 to 2 new products in 2020 Reaching >70% of market via top 5,000 prescribing dermatologists $3.6 $15.5 $23.4 $23.8 $9.2 2016 2017 2018 2019 *Actuals through Q3 2019 **Projected revenue through Q4 2019 ~$33 - $36M * ** $ in millions

Identify Monetize Develop Strategy To build a pipeline of both development - stage / commercial - stage assets and leverage the most efficient course to move products forward with our partners. 8

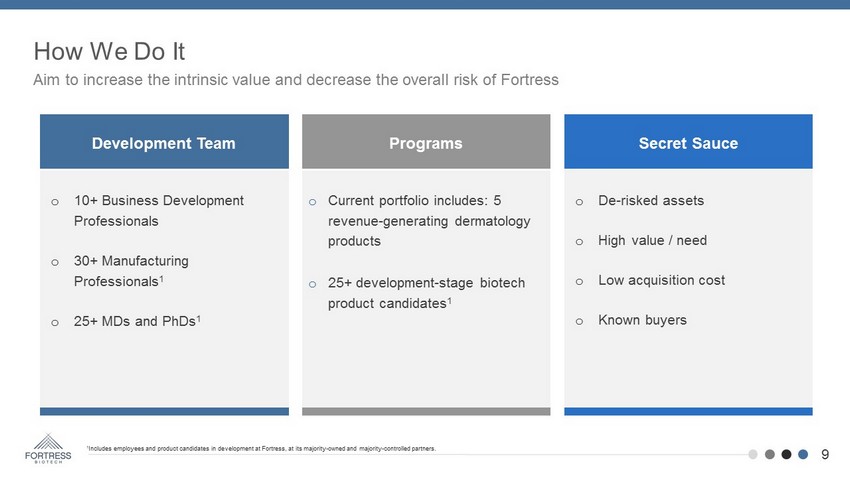

9 Development Team Programs Secret Sauce How We Do It o 10+ Business Development Professionals o 30+ Manufacturing Professionals 1 o 25+ MDs and PhDs 1 o Current portfolio includes: 5 revenue - generating dermatology products o 25+ development - stage biotech product candidates 1 o De - risked assets o High value / need o Low acquisition cost o Known buyers 1 Includes employees and product candidates in development at Fortress, at its majority - owned and majority - controlled partners. Aim to increase the intrinsic value and decrease the overall risk of Fortress

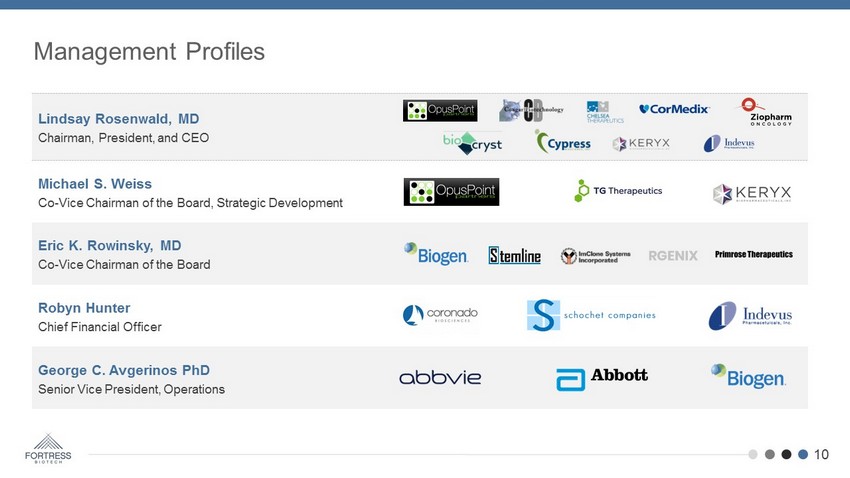

Lindsay Rosenwald, MD Chairman, President, and CEO Michael S. Weiss Co - Vice Chairman of the Board, Strategic Development Eric K. Rowinsky , MD Co - Vice Chairman of the Board Robyn Hunter Chief Financial Officer George C. Avgerinos PhD Senior Vice President, Operations Management Profiles 10

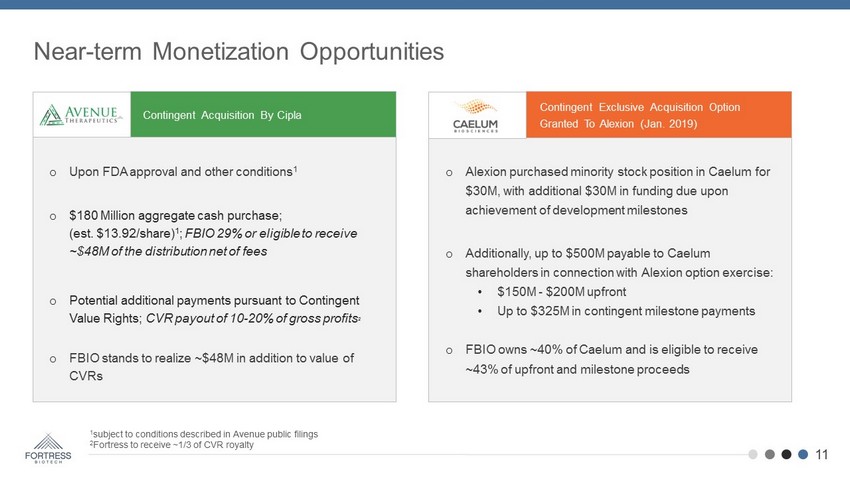

o Upon FDA approval and other conditions 1 o $180 Million aggregate cash purchase; (est. $13.92/share) 1 ; FBIO 29% or eligible to receive ~$48M of the distribution net of fees o Potential additional payments pursuant to Contingent Value Rights; CVR payout of 10 - 20% of gross profits 2 o FBIO stands to realize ~$48M in addition to value of CVRs o Alexion purchased minority stock position in Caelum for $30M, with additional $30M in funding due upon achievement of development milestones o Additionally, up to $500M payable to Caelum shareholders in connection with Alexion option exercise: • $150M - $200M upfront • Up to $325M in contingent milestone payments o FBIO owns ~40% of Caelum and is eligible to receive ~43% of upfront and milestone proceeds Near - term Monetization Opportunities 1 subject to conditions described in Avenue public filings 2 Fortress to receive ~1/3 of CVR royalty Contingent Exclusive Acquisition Option Granted To Alexion (Jan. 2019) Contingent Acquisition By Cipla 11

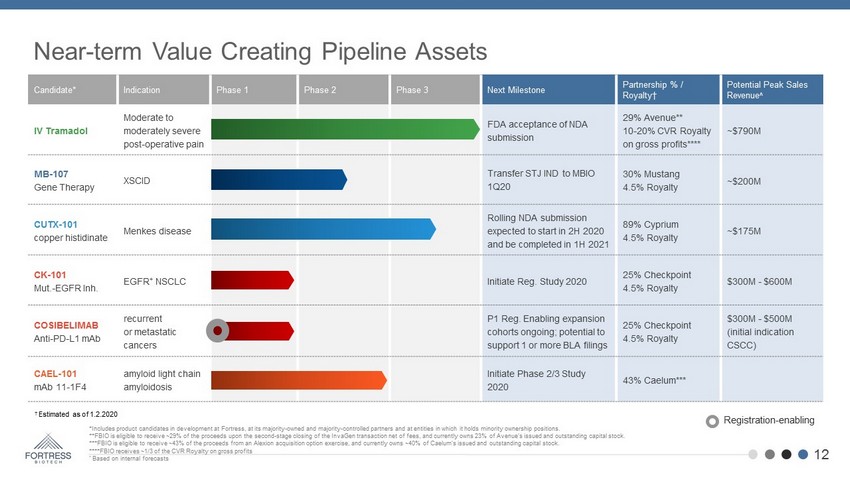

Candidate* Indication Phase 1 Phase 2 Phase 3 Next Milestone Partnership % / Royalty † Potential Peak Sales Revenue^ IV Tramadol Moderate to moderately severe post - operative pain FDA acceptance of NDA submission 29% Avenue** 10 - 20% CVR Royalty on gross profits**** ~$790M MB - 107 Gene Therapy XSCID Transfer STJ IND to MBIO 1Q20 30% Mustang 4.5% Royalty ~$200M CUTX - 101 copper histidinate Menkes disease Rolling NDA submission expected to start in 2H 2020 and be completed in 1H 2021 89% Cyprium 4.5% Royalty ~$175M CK - 101 Mut . - EGFR Inh . EGFR + NSCLC Initiate Reg. Study 2020 25% Checkpoint 4.5% Royalty $300M - $600M COSIBELIMAB Anti - PD - L1 mAb recurrent or metastatic cancers P1 Reg. Enabling expansion cohorts ongoing; potential to support 1 or more BLA filings 25% Checkpoint 4.5% Royalty $300M - $500M (initial indication CSCC) CAEL - 101 mAb 11 - 1F4 amyloid light chain amyloidosis Initiate Phase 2/3 Study 2020 43% Caelum*** Near - term Value Creating Pipeline Assets Registration - enabling † Estimated as of 1.2.2020 *Includes product candidates in development at Fortress, at its majority - owned and majority - controlled partners and at entities in which it holds minority ownership positions. **FBIO is eligible to receive ~29% of the proceeds upon the second - stage closing of the InvaGen transaction net of fees, and currently owns 23% of Avenue’s issued and outstanding capital stock. ***FBIO is eligible to receive ~43% of the proceeds from an Alexion acquisition option exercise, and currently owns ~40% of C ael um’s issued and outstanding capital stock. ****FBIO receives ~1/3 of the CVR Royalty on gross profits ^ Based on internal forecasts 12

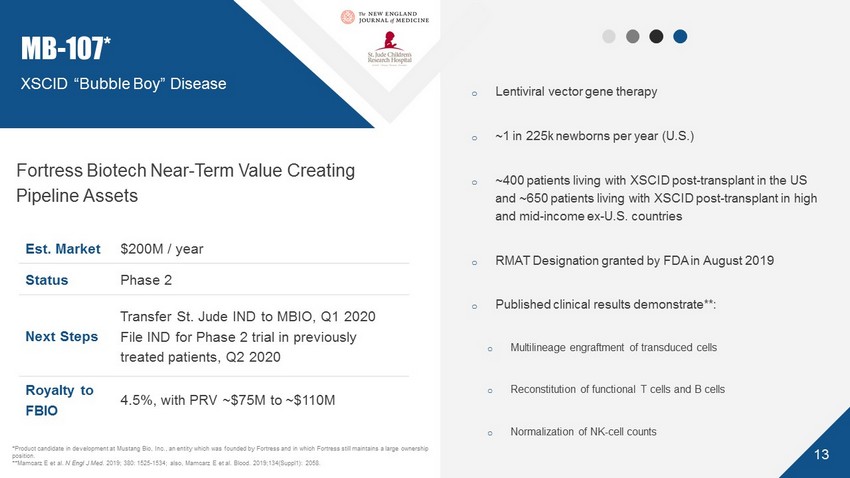

13 o Lentiviral vector gene therapy o ~1 in 225k newborns per year (U.S.) o ~400 patients living with XSCID post - transplant in the US and ~650 patients living with XSCID post - transplant in high and mid - income ex - U.S. countries o RMAT Designation granted by FDA in August 2019 o Published clinical results demonstrate**: o Multilineage engraftment of transduced cells o Reconstitution of functional T cells and B cells o Normalization of NK - cell counts MB - 107* Fortress Biotech Near - Term Value Creating Pipeline Assets XSCID “Bubble Boy” Disease Est. Market $200M / year Status Phase 2 Next Steps Transfer St. Jude IND to MBIO, Q1 2020 File IND for Phase 2 trial in previously treated patients, Q2 2020 Royalty to FBIO 4.5%, with PRV ~$75M to ~$110M *Product candidate in development at Mustang Bio, Inc., an entity which was founded by Fortress and in which Fortress still m ain tains a large ownership position. ** Mamcarz E et al. N Engl J Med. 2019; 380: 1525 - 1534; also, Mamcarz E et al. Blood. 2019;134(Suppl1): 2058.

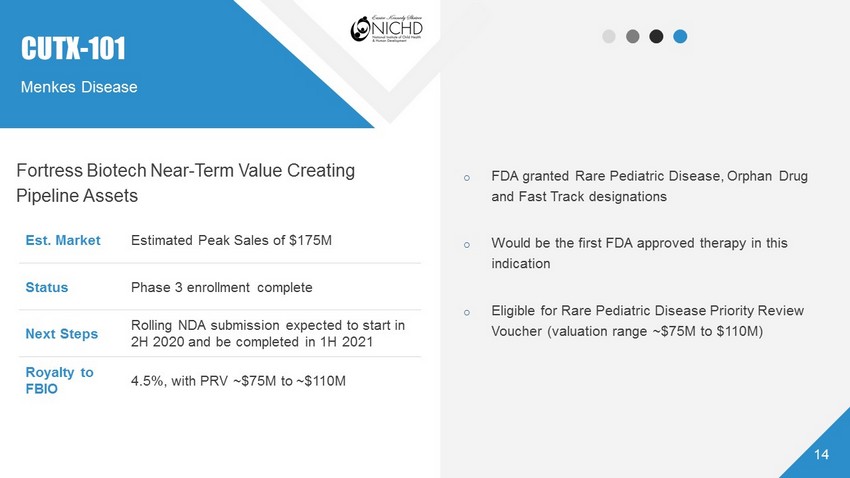

14 o FDA granted Rare Pediatric Disease, Orphan Drug and Fast Track designations o Would be the first FDA approved therapy in this indication o Eligible for Rare Pediatric Disease Priority Review Voucher (valuation range ~$75M to $110M) CUTX - 101 Fortress Biotech Near - Term Value Creating Pipeline Assets Menkes Disease Est. Market Estimated Peak Sales of $175M Status Phase 3 enrollment complete Next Steps Rolling NDA submission expected to start in 2H 2020 and be completed in 1H 2021 Royalty to FBIO 4.5%, with PRV ~$75M to ~$110M

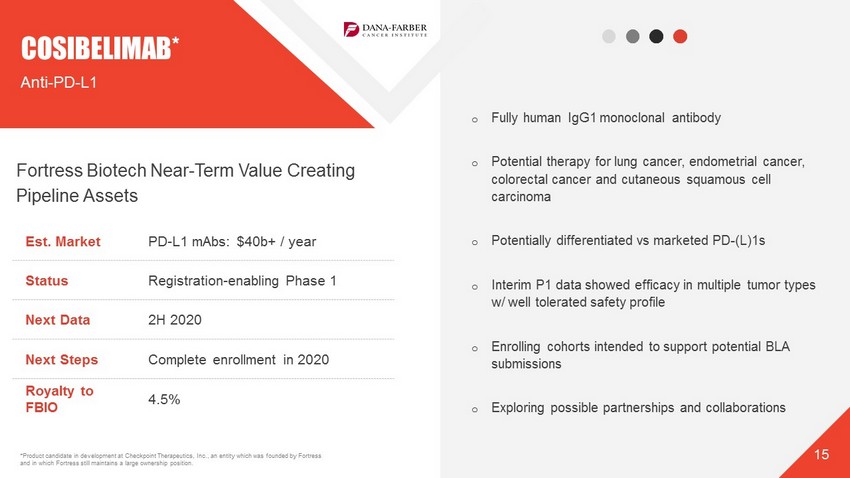

15 o Fully human IgG1 monoclonal antibody o Potential therapy for lung cancer, endometrial cancer, colorectal cancer and cutaneous squamous cell carcinoma o Potentially differentiated vs marketed PD - (L)1s o Interim P1 data showed efficacy in multiple tumor types w/ well tolerated safety profile o Enrolling cohorts intended to support potential BLA submissions o Exploring possible partnerships and collaborations COSIBELIMAB* Fortress Biotech Near - Term Value Creating Pipeline Assets Anti - PD - L1 Est. Market PD - L1 mAbs : $40b+ / year Status Registration - enabling Phase 1 Next Data 2H 2020 Next Steps Complete enrollment in 2020 Royalty to FBIO 4.5% *Product candidate in development at Checkpoint Therapeutics, Inc., an entity which was founded by Fortress and in which Fortress still maintains a large ownership position.

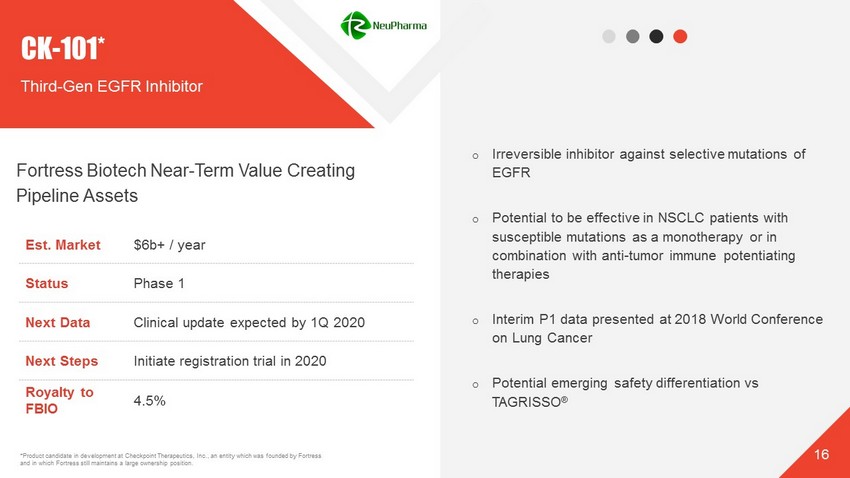

16 o Irreversible inhibitor against selective mutations of EGFR o Potential to be effective in NSCLC patients with susceptible mutations as a monotherapy or in combination with anti - tumor immune potentiating therapies o Interim P1 data presented at 2018 World Conference on Lung Cancer o Potential emerging safety differentiation vs TAGRISSO ® CK - 101* Fortress Biotech Near - Term Value Creating Pipeline Assets Third - Gen EGFR Inhibitor *Product candidate in development at Checkpoint Therapeutics, Inc., an entity which was founded by Fortress and in which Fortress still maintains a large ownership position. Est. Market $6b+ / year Status Phase 1 Next Data Clinical update expected by 1Q 2020 Next Steps Initiate registration trial in 2020 Royalty to FBIO 4.5%

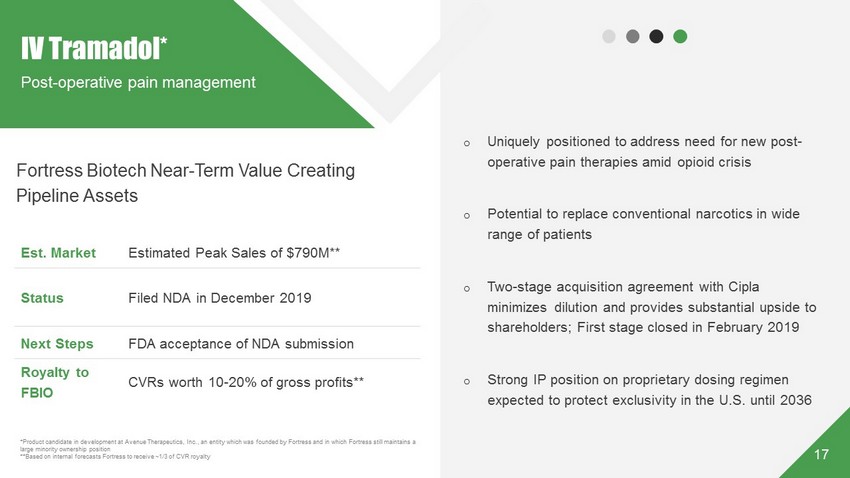

Est. Market Estimated Peak Sales of $790M** Status Filed NDA in December 2019 Next Steps FDA acceptance of NDA submission Royalty to FBIO CVRs worth 10 - 20% of gross profits** 17 o Uniquely positioned to address need for new post - operative pain therapies amid opioid crisis o Potential to replace conventional narcotics in wide range of patients o Two - stage acquisition agreement with Cipla minimizes dilution and provides substantial upside to shareholders; First stage closed in February 2019 o Strong IP position on proprietary dosing regimen expected to protect exclusivity in the U.S. until 2036 IV Tramadol* Fortress Biotech Near - Term Value Creating Pipeline Assets Post - operative pain management *Product candidate in development at Avenue Therapeutics, Inc., an entity which was founded by Fortress and in which Fortress st ill maintains a large minority ownership position **Based on internal forecasts Fortress to receive ~1/3 of CVR royalty

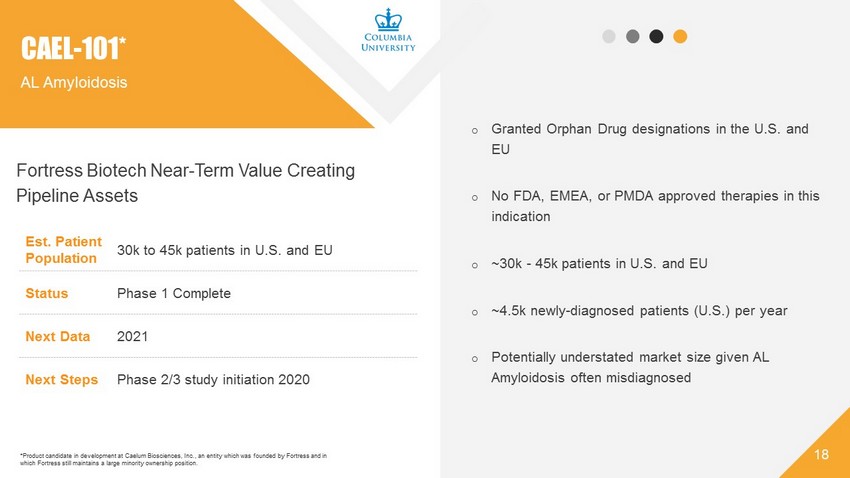

18 o Granted Orphan Drug designations in the U.S. and EU o No FDA, EMEA, or PMDA approved therapies in this indication o ~30k - 45k patients in U.S. and EU o ~4.5k newly - diagnosed patients (U.S.) per year o Potentially understated market size given AL Amyloidosis often misdiagnosed CAEL - 101* Fortress Biotech Near - Term Value Creating Pipeline Assets AL Amyloidosis *Product candidate in development at Caelum Biosciences, Inc., an entity which was founded by Fortress and in which Fortress still maintains a large minority ownership position. Est. Patient Population 30k to 45k patients in U.S. and EU Status Phase 1 Complete Next Data 2021 Next Steps Phase 2/3 study initiation 2020

Top - tier Academic & Commercial Partners 19

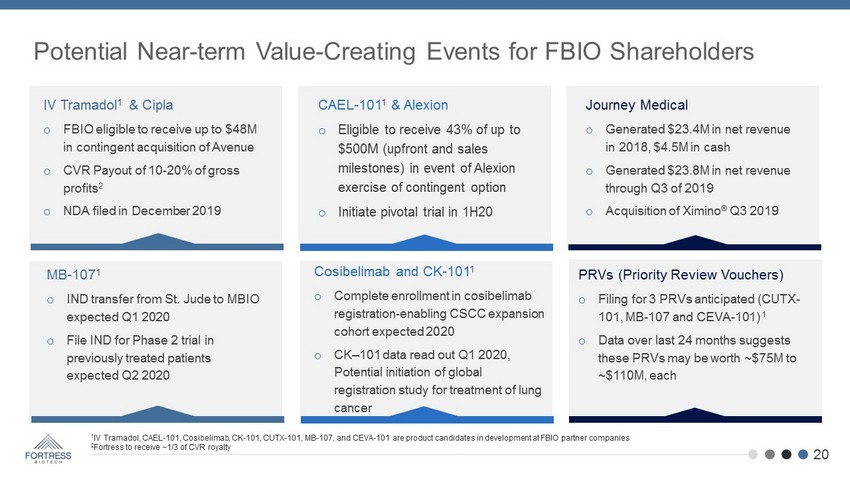

Potential Near - term Value - Creating Events for FBIO Shareholders 1 IV Tramadol, CAEL - 101, Cosibelimab, CK - 101, CUTX - 101, MB - 107, and CEVA - 101 are product candidates in development at FBIO partner companies 2 Fortress to receive ~1/3 of CVR royalty IV Tramadol 1 & Cipla o FBIO eligible to receive up to $48M in contingent acquisition of Avenue o CVR Payout of 10 - 20% of gross profits 2 o NDA f iled in December 2019 MB - 107 1 o IND transfer from St. Jude to MBIO expected Q1 2020 o File IND for Phase 2 trial in previously treated patients expected Q2 2020 Journey Medical o Generated $23.4M in net revenue in 2018, $4.5M in cash o Generated $23.8M in net revenue through Q3 of 2019 o Acquisition of Ximino ® Q3 2019 Cosibelimab and CK - 101 1 o Complete enrollment in cosibelimab registration - enabling CSCC expansion cohort expected 2020 o CK – 101 data read out Q1 2020, Potential initiation of global registration study for treatment of lung cancer 20 PRVs (Priority Review Vouchers) o Filing for 3 PRVs anticipated (CUTX - 101, MB - 107 and CEVA - 101) 1 o Data over last 24 months suggests these PRVs may be worth ~$75M to ~$110M, each CAEL - 101 1 & Alexion o Eligible to receive 43% of up to $500M (upfront and sales milestones ) in event of Alexion exercise of contingent option o Initiate pivotal trial in 1H20

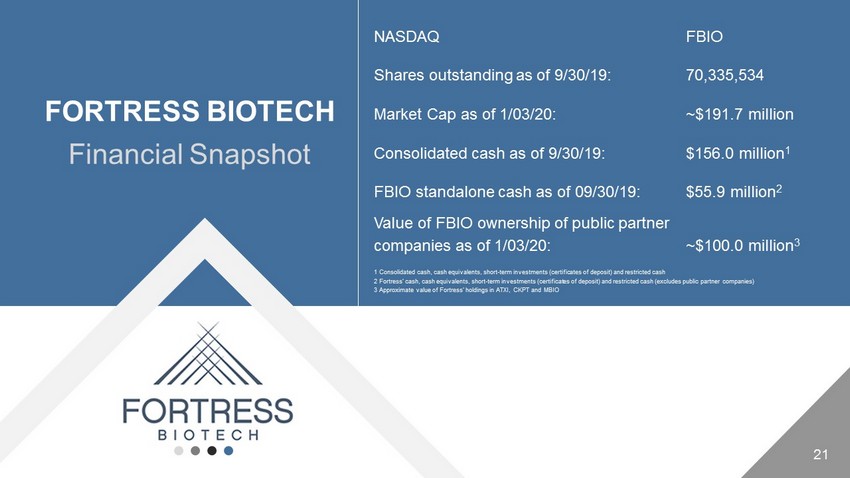

NASDAQ FBIO Shares outstanding as of 9/30/19: 70,335,534 Market Cap as of 1/03/20: ~$191.7 million Consolidated cash as of 9/30/19: $156.0 million 1 FBIO standalone cash as of 09/30/19: $55.9 million 2 Value of FBIO ownership of public partner companies as of 1/03/20: ~$100.0 million 3 1 C onsolidated cash, cash equivalents, short - term investments (certificates of deposit) and restricted cash 2 Fortress’ cash, cash equivalents, short - term investments (certificates of deposit) and restricted cash (excludes public partner companies) 3 Approximate value of Fortress’ holdings in ATXI, CKPT and MBIO 21 FORTRESS BIOTECH Financial Snapshot

Investment Highlights 22 o World class management team with extensive experience in all facets of biotech with multiple successful exits ; o Implementing revenue generating model focusing on low risk and low cost portfolio acquisition using strategic partners for funding ; o Deep existing portfolio with multiple opportunities for cash generation, well in excess of preferred dividend .